How to boost your investment returns by 3%… watch this

Yes this is a true fact you can potentially boost your investment returns by 3%..

No this isn’t some scam investment in wine, cheese or some random offshore property fund that never actually builds any property….

This is about using the right professionals to help you with your investment journey.

I’m Gareth Shears and I am a chartered financial planner and one of the co-founders of the multi award winning Sanctuary Chartered Financial planners and I have been advising clients on all aspects of financial advice for over 14 years.

What’s this all about then?

Vanguard have been carrying out there adviser alpha concept since 2001.

In creating the Vanguard Adviser’s AlphaTM concept in 2001, they outlined how advisers could add value, or alpha, through relationship-oriented services such as providing wealth management via financial planning, discipline and guidance, rather than by trying to outperform the market.

Since then, their work in support of the concept has continued. This paper takes the Adviser’s Alpha framework further by attempting to quantify the benefits that advisers can add relative to others who are not using such strategies. Each of these can be used individually or in combination, depending on the strategy.

They believe implementing the Vanguard Adviser’s Alpha framework can add about 3% in net returns for clients and also allow them to differentiate their skills and practice.

Like any approximation, the actual amount of value added may vary significantly, depending on clients’ circumstances.

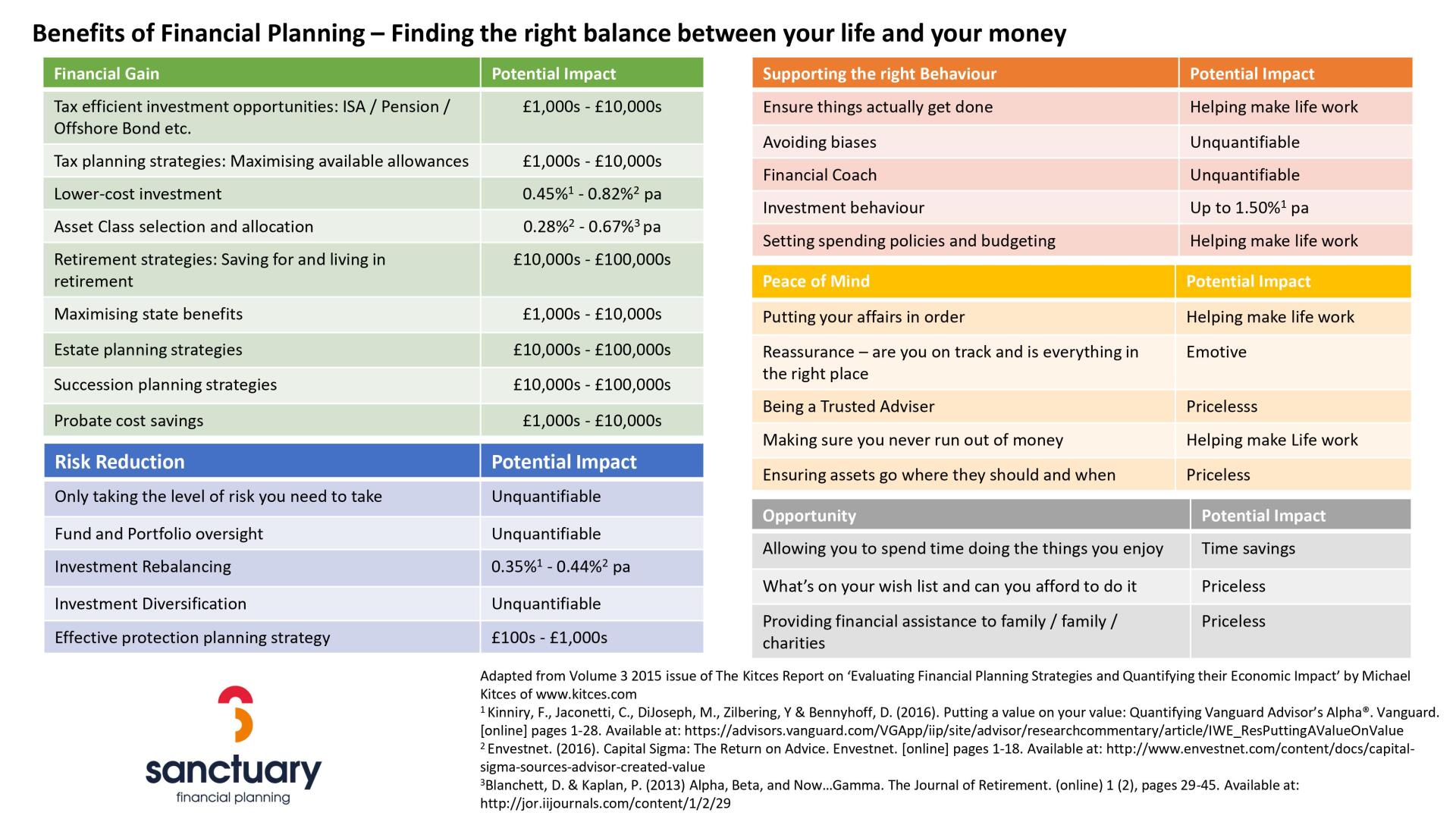

This is how they say you can get up to an extra 3% returns using an adviser.

Now let me caveat this.

This is not guaranteed and will vary from adviser to adviser, but you will be better off.

- Suitable asset allocation: Making sure you have a well diversified portfolio of the great companies of the world.

- Cost effective implementation: Cost is one of the biggest destroyers of wealth so ensuring you don’t pay too much for your platform and funds is one part of what a financial adviser should do. We can control cost we can’t control what happens in markets

- Rebalancing: Making sure your investments stay aligned to the original set up is key as you don’t want too much in bonds to lower your risk or too much in equities to increase your risk. Rebalancing is a job that no one ever sees when using an adviser as it happens in the background. Advisers will also ensure this is done in the most tax efficient way ensuring you don’t pay any unnecessary taxes.

- Behavioural coaching: This is actually the biggest part to what proper financial advice should be. Stopping your from doing the wrong thing at wrong time for wrong reasons. Making sure you don’t try and jump out of your investments when you see short term volatility in the markets. Staying strong and trusting in the process and what history tells us.

- Tax allowances: Making sure you use your tax efficient allowances each year, pensions, ISAs, VCTs and many more. This saves you huge amounts of tax on growth of your investments meaning your overall performance is better.

- Withdrawal order: Making sure if you need to take money out it’s done so in the right order.

Here is a simple example:

Inheritance tax is 40%. We have many clients coming to us with large cash sums and they are drawing all their income from their pensions. Money held in pensions in the format of defined contribution are protected from inheritance tax.

Therefore it may make sense to draw from your cash reserves at the outset to help reduce your estate value naturally and keep your pensions until you really need it. You can leave your pension to your partner, children, grandchildren or even Barry down the pub if you want.

There are lots of other benefits of an adviser you may actually never see.

What we do isn’t just about investing money there is a lot more to it than that.

To summarise using a financial adviser has huge benefits to ensure you stay on track with your financial plans for the future.

And Yes it can boost your investment returns.

SO don’t listen to all these people saying using a financial adviser is a bad thing.

I actually think trying to do it yourself is the fastest way to destroy your wealth rather than build it